In this video we’re going to talk about the breakeven figure, your breakeven figure is how much money needs to be in your till, or how many sales you need to make each week to cover your costs.

This simple spreadsheet has been designed purely for you to be able just to plug in what you think or, what you know your expenses are. If you haven’t started a business yet, or you’re looking at making changes, you can put in projected figures.

If you are already trading then you will know what those figures are (you can take them from your P&L) and just plug them into the column on the left hand side.

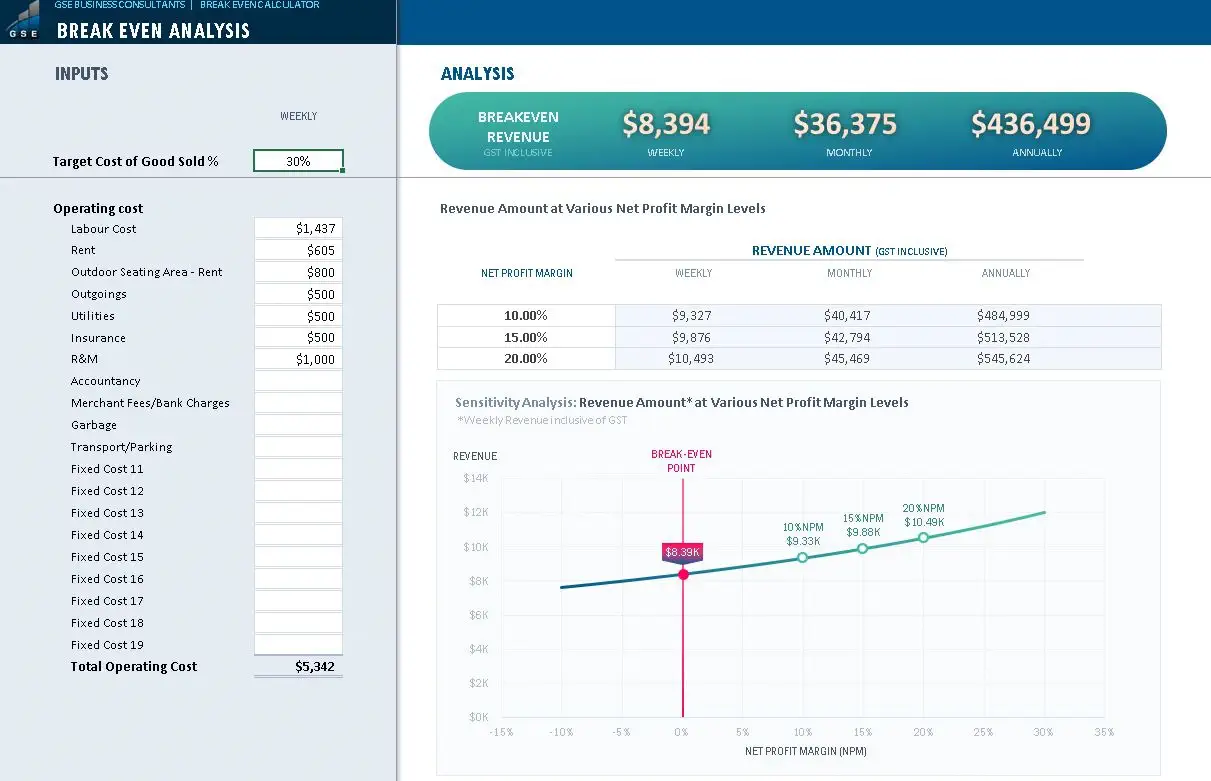

I’ve set this basically so that you can put in what your target cost of goods sold is in this example you can see I’ve just put 30% as a fairly standard benchmark figure.

You then go through and just add the other costs as you go down, can change the expense calls to make them relevant to whatever you want to, but basically you’re going to go down and work out what your total weekly running costs are.

From there you’re going to get a total of your operating costs at the bottom. This figure then carries across over to this side and what this is doing is working out that if your costs of $5300 what you actually need to take to cover those costs, allowing for a 30% margin on your food and GST, of course, is that you need to take in $8394 to cover that cost.

One mistake that a lot of people make is that they think that if their costs are at a certain level that they only got to bring that amount in, but it doesn’t work that way.

Looking at that breakeven figure, naturally you don’t want to just be covering costs you want to be targeting, at least a 10% 15% or 20% bet margin on that, bear in mind also that the (labour cost) figure typically doesn’t include your income.

So, you really want to be, I would suggest adding your income or what you want to pay yourself to labour costs in this spreadsheet, because understandably you should be paying yourself from the business.

On top of that you should still be aiming to make a 10% or 15%, minimum net profit so in this scenario with a cost of $5342 we are looking at the standard breakeven $8394 but ideally you’re targeting these figures in the table below so that $9000 to $10,000 per week in order to make sure that you’re not just covering costs, you’re actually paying yourself, and you’re making a decent net margin as well.

The overall the value of your business is going to be determined partly by the level of profit but also the percentage of net profit that you’re running at as well. Your net profit percentage should definitely be one of the KPIs that you’re looking at.

In this scenario, that’s what we’re looking at the targeting the middle of the road, if you said 15% margin you want to be aiming for at least the high $9000s a week.

The diagram or chart at the bottom is basically showing you the same information just displayed in a different way.

This spreadsheet is a very simple tool designed to be easy to use. If you’re making a structure change at the moment, i.e. switching over to a takeaway model due to Covid restrictions then this could be a good chance to check that you are still profitable.

You don’t necessarily need to use this kind of spreadsheet you can of course do this with pen and paper, but I would encourage you to make sure that you’re accurately working out how much money you need to bring in.

As you can see in this spreadsheet format if that food cost jumps up to, let’s say 35% you can see the difference that that makes to that breakeven figure.

This shows just how important it is that you’re tracking these numbers and keeping on them regardless of what stage you’re at, whether you’re planning to open somewhere, or you’re already operating at the moment it’s very important that you do know what that breakeven figure is.

As always, if you have any questions, feedback or comments feel free to post them below, if you’re watching this inside the GSE Hub Members area then of course you can reach out in the usual way to any of us if you’d like any support or help running through this.

If you are not already a GSE Hub member and you would like access to cost effective coaching as well tools and resources such as this then you can find out more at The GSE Hub.